Does Toyota Prius Qualify For Tax Credit

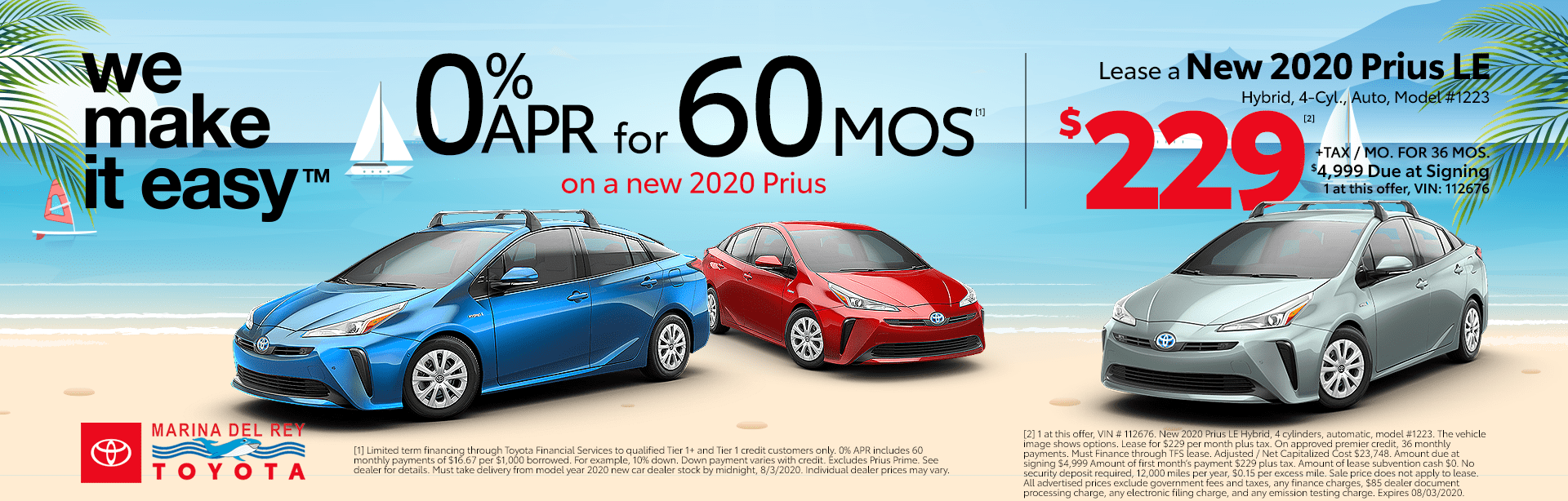

The list includes the 2020 toyota prius prime 2020 honda clarity phev 2020 chrysler pacifica hybrid and upcoming 2021 toyota rav4 prime.

Does toyota prius qualify for tax credit. Other plug in hybrids typically qualify for credits. But if your vehicle qualifies for a 7500 tax credit and your federal tax bill is only 4000 you can. For example if you owe 8000 in federal income tax a 5000 alternative energy vehicle tax credit would reduce the amount you owe to 3000.

Toyota hybrids phased out in 2007 and honda hybrid credits expired early in 2009. Beginning on january 1 2019. C2020 toyota motor sales usa inc.

As of september 2020. Only the toyota prius plug in hybrid is eligible for the tax credit. Partial credits were available for some hybrids sold by bmw cadillac chevrolet gmc mercedes benz and nissan.

1 best answer accepted solutions highlighted. A tax credit reduces the total amount of income tax an individual owes the federal government. The use of olympic marks terminology and imagery is authorized by the us.

31 2010 end for all credits neared only a few hybrids still qualified for the credits. The irs tax credit is for 2500 to 7500 per new ev electric vehicle purchased for use in the us. Ford reached phase out early in 2010.

Go to this website for the vehicles eligible for the energy efficient vehicle. Olympic paralympic committee pursuant to title 36 us. All information applies to us.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7500. 0 1 368 reply.

What vehicles currently qualify for the federal credit. The credit will begin to phase out when at least 200000 qualifying vehicles manufactured by each manufacturer have been sold in the us. I have a 2016 prius hybrid non plug in do i still qualify for a tax credit.

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.