Do You Get A Tax Credit For Buying A Toyota Prius

Uncover savings by driving a 2021 prius prime.

Do you get a tax credit for buying a toyota prius. Toyota hybrids phased out in 2007 and honda hybrid credits expired early in 2009. Toyota says the difference comparably equipped is more like 1000 to 1500 less for the hybrid prius. 31 2010 end for all credits neared only a few hybrids still qualified for the credits.

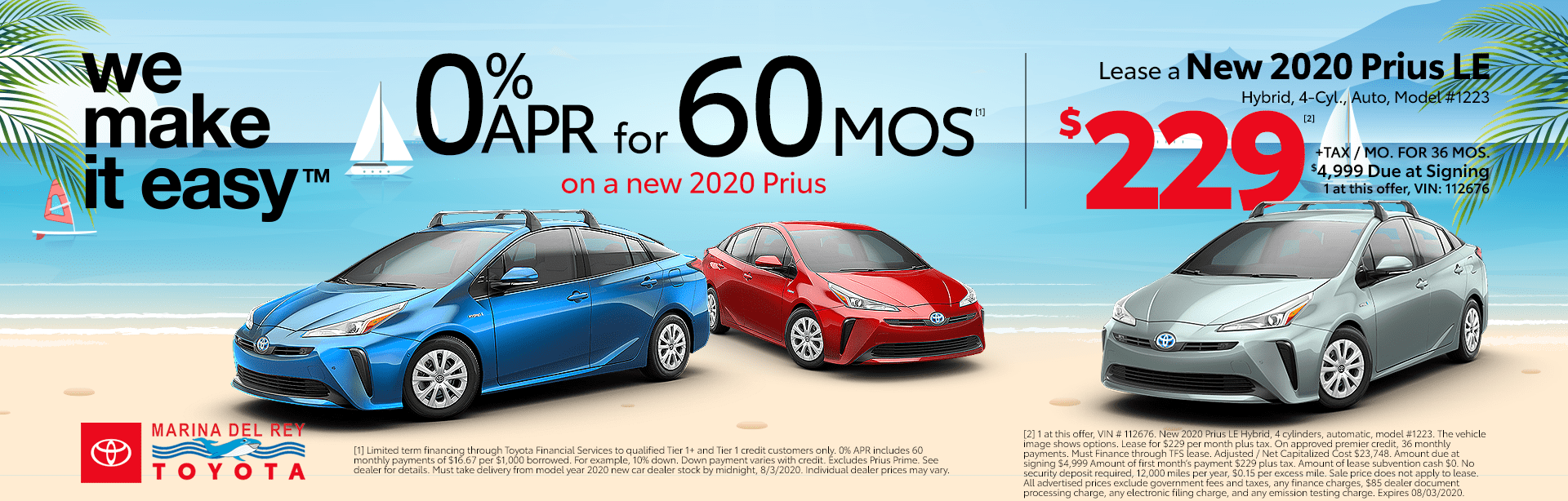

Discover all the ways you can save with your prius prime including incentives rebates and fuel consumption savings. Regardless a tax credit equals money in your pocket. In other words buying a 2020 toyota prius wont get you a tax credit.

For example the toyota prius prime a plug in. Also check that any applicable recalls have been carried out on the car youre looking to buy. We received the tax credit for both of them however earlier this year we received a letter from irs stating that one of the vehicles did not qualify as they stated our tax preparer put electic plug in vehicle which neither is.

Ford reached phase out early in 2010. A used hybrid can come with some serious baggage. Except for models from general motors and tesla all mainstream mass produced full electric vehicles on sale in america qualify for the full 7500 credit.

We purchased 2 hybrid vehicles in 2017 2017 toyota prius iv and toyota rav4 xle. However purchasing a 2020 toyota prius prime plug in hybrid can potentially get you some money back. Like any other car we recommend you consider buying a toyota prius from a known reputable dealer.

Thats all the tax credit will be. Deciding on a used car is not easy especially when you are considering a toyota prius. Either way the federal tax credit available to anyone buying a prius prime in the us.

Here are 4 things to look out for when selecting the prius. But if your vehicle qualifies for a 7500 tax credit and your federal tax bill is only 4000 you can only claim a credit for 4000.

New 2021 Toyota Prius 20th Anniversary Edition Hatchback In Escondido 1027654 Toyota Escondido

www.toyotaescondido.com